Governance that transforms: Governance strategies for micro, small, and medium enterprises in Pernambuco

DOI:

https://doi.org/10.24883/eagleSustainable.v15i.488Keywords:

Corporate Governance, Micro, Small, and Medium Enterprises (MSMEs), Local Productive Arrangement (LPA), Strategic Management, Social and Environmental ResponsibilityAbstract

Purpose: This article aims to analyze the governance practices adopted by small businesses that make up the Local Productive Arrangement of Clothing in the Agreste region of Pernambuco.

Methodology/approach: This is a quantitative and descriptive study, conducted in 33 companies from the clothing, laundry, and textile sectors. Data were collected through a structured questionnaire with a Likert scale and analyzed using Microsoft Excel and the SPSS software, version 20.0.

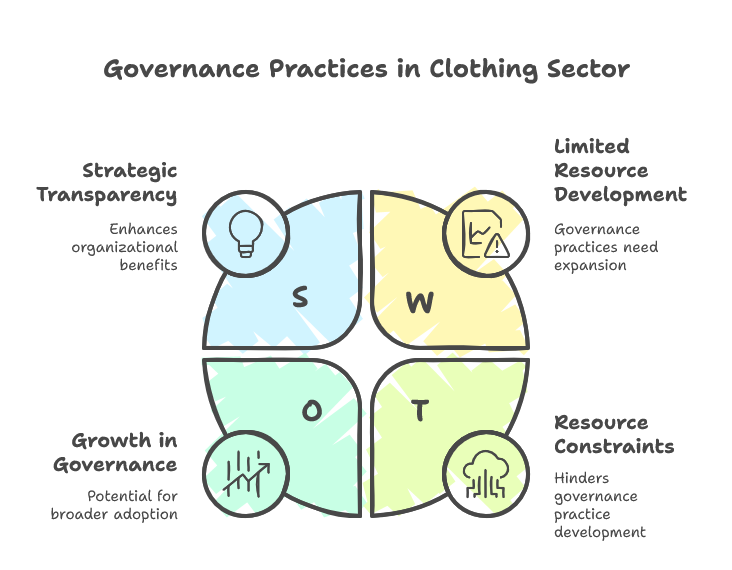

Originality/Relevance: Although the companies adopt governance practices, there are indications that these practices need to be further developed and adopted by a greater number of companies, which happens due to limited resources.

Key findings: The results show that companies adopt practices of transparency and elements of environmental and social responsibility, bringing strategic benefits to the organization. The organizations value corporate governance practices. There is an adoption of transparency with suppliers, banks, partners, and the government, which can bring benefits to the organization, such as facilitating the acquisition of external resources. Finally, despite the existence of governance practices within the institutions, they need to invest more in this area.

Theoretical/methodological contributions: Academically, the results expand the knowledge on governance in MSMEs in the Brazilian context in the Local Productive Arrangement of Clothing in the Agreste region of Pernambuco, highlighting the relevance of governance practices in these companies. Additionally, the findings also contributed to the literature by highlighting the opportunities and challenges of this sector in the regional context.

Downloads

References

Abor, J., & Adjasi, C. K. D. (2007). Corporate governance and the small and medium enterprises sector: Theory and implications. Q Emerald Group Publishing Limited, 7(2), 111-122. https://doi.org/10.1108/14720700710739769 DOI: https://doi.org/10.1108/14720700710739769

Abu Khadra, H., & Delen, D. (2020). Nonprofit organization fraud reporting: Does governance matter? International Journal of Accounting & Information Management, 28(3), 409-428. https://doi.org/10.1108/IJAIM-10-2019-0117 DOI: https://doi.org/10.1108/IJAIM-10-2019-0117

Almeida, M. A., & Santos, J. F. (2010). Evolução da qualidade das práticas de governança corporativa: Um estudo das empresas brasileiras de capital aberto não listadas em bolsa. RAC. Revista de Administração Contemporânea, 14, 907-924. DOI: https://doi.org/10.1590/S1415-65552010000500009

Amcham-BH Comitê Estratégico de Governança Corporativa. (2011). Governança corporativa aplicada a empresas de pequeno e médio porte (Cartilha). Recuperado em 20 fev. 2024, de: http://www.anjosdobrasil.net/uploads/7/9/5/6/7956863/cartilha_governanca_corp_aplicada_a_peq_e_media_empr_01_07_11x.pdf.

Americo, J. C. D. S. (2022). Mecanismos de governança corporativa conferem resiliência organizacional? Evidências de organizações cooperativas agropecuárias.

Antero, C. A. D. S., rodrigues, C. T., emmendoerfer, M. L., & dallabrida, V. R.. (2020). Política pública de apoio ao desenvolvimento de APLs: Uma análise do impacto em Minas Gerais, Brasil. Cad. EBAPE.BR, 18(1), 61-73. DOI: https://doi.org/10.1590/1679-395176924

Aparicio, K., & Kim, R. (2023). External capital market frictions, corporate governance, and tax avoidance: Evidence from the TED spread. Finance Research Letters, 52, 103381. https://doi.org/10.1016/j.frl.2022.103381 DOI: https://doi.org/10.1016/j.frl.2022.103381

Botelho, M. dos R. A., Sousa, D. de F., Carrijo, M. de C., Ferreira, J. B., Silva, A. C. da. (2022). Survival determinants for Brazilian companies, 1996 to 2016. Journal of Industrial and Business Economics, 49(2), 233-266. https://doi.org/10.1007/s40812-022-00217-1 DOI: https://doi.org/10.1007/s40812-022-00217-1

Cambridge Family Enterprise Group. (2024). Sucessão do CEO em empresas familiares. Recuperado em 09 dez 2024. de: https://cfeg.com/insights_research/sucessao-do-ceo-em-empresas-familiares#:~:text=A%20sucess%C3%A3o%20%C3%A9%20um%20processo%20din%C3%A2mico,-Quando%20bem%20realizada&text=No%20melhor%20dos%20casos%2C%20se,tomada%20de%20decis%C3%B5es%20sejam%20claras.

Carmona, P., Fuentes, C. D., & Ruiz, C. (2016). Risk disclosure analysis in the corporate governance annual report using fuzzy-set qualitative comparative analysis. Revista de Administração de Empresas, 56(3), 342-352. DOI: https://doi.org/10.1590/S0034-759020160307

Creswell, J. W., & Creswell, J. D. (2021). Projeto de pesquisa: Métodos qualitativo, quantitativo e misto (5. ed.). Porto Alegre: Penso.

Deconto, A. C., Kruger, S. D., & Zanin, A. (2023). Mecanismos de compliance e anticorrupção em indústrias da região Sul do Brasil. Revista Catarinense da Ciência Contábil, 22, e3344-e3344. https://doi.org/10.16930/2237-766220233344 DOI: https://doi.org/10.16930/2237-7662202333442

Dube, I., Dube, D., & Mishra, P. (2011). Corporate governance norm for SME. Journal of Public Administration and Governance, 1(2). https://doi.org/10.5296/jpag.v1i2.889 DOI: https://doi.org/10.5296/jpag.v1i2.889

Dunne, T. C., & McBrayer, G. A. (2019). In the interest of small business' cost of debt: A matter of CSR disclosure. Journal of Small Business Strategy, 29(2), 58-71.

Ethos, Instituto Ethos de Empresas e Responsabilidade Social. (2003). Responsabilidade social empresarial para micro e pequenas empresas – Passo a passo. Recuperado em 20 jan 2024, de: http://www.ufal.edu.br/empreendedorismo/downloads/manuais-guias-cartilhas-e-documentos-sobre-empreendedorismo-e-inovacao/manual-de-responsabilidade-social-empresarial-para-micro-e-pequenas-empresas.

Fabro, J., Vargas, V. Z., & Philereno, D. C. (2013). Governança corporativa: Um estudo de caso em 11 empresas de médio porte no município de Caxias do Sul - RS. Revista Contabilidade, Ciência da Gestão e Finanças, 1(1), 54-72.

Fernandes, C. A. A. (2014). Governo das sociedades, custos de agência e crise financeira: Que relação?. Navus: Revista de Gestão e Tecnologia, 4(1), 6-21. https://doi.org/10.22279/navus.2014.v4n1.p06-21.132 DOI: https://doi.org/10.22279/navus.2014.v4n1.p06-21.132

Fonseca, C. V. C., Silveira, R. L. F., & Hiratuka, C. (2016). A relação entre a governança corporativa e a estrutura de capital das empresas brasileiras no período 2000-2013. Enfoque Reflexão Contábil, 35(2), 35-52. https://doi.org/10.4025/enfoque.v35i2.29673 DOI: https://doi.org/10.4025/enfoque.v35i2.29673

Freire, J. R., Lemke, V., & Souza, A. C. (2011). Mistura das contas pessoais e patrimoniais em micro e pequenas empresas: Estudos múltiplos de casos no setor supermercadista de Santa Teresa – ES. In VIII Convibra Administração – Congresso Virtual Brasileiro de Administração. Recuperado em 15 fev, 2024, de: http://www.convibra.org/upload/paper/adm/adm_3460.pdf.

Gil, A. C. (2017). Como elaborar projetos de pesquisa (6. ed.). São Paulo: Atlas.

Gils, A. V. (2005). Management and governance in Dutch SMEs. European Management Journal, 23(5), 583-589. https://doi.org/10.1016/j.emj.2005.09.013 DOI: https://doi.org/10.1016/j.emj.2005.09.013

Hakimah, Y., Pratamab, I., Fitric, H., Ganatrid, M., & Sulbahri, R. A. (2019). Impact of intrinsic corporate governance on financial performance of Indonesian SMEs. International Journal of Innovation, Creativity and Change, 7(1), 32-51.

Hart, O. (1995). Corporate governance: Some theory and implications. The Economic Journal, 105(430), 678-689. https://doi.org/10.2307/2235027 DOI: https://doi.org/10.2307/2235027

Instituto Brasileiro de Governança Corporativa (IBGC). (2014). Caderno de boas práticas de governança corporativa para empresas de capital fechado: Um guia para sociedades limitadas e sociedades por ações fechadas. São Paulo: IBGC.

Instituto Brasileiro de Governança Corporativa (IBGC). (2009). Código das melhores práticas de governança corporativa (4. ed.). São Paulo: IBGC.

Jain, S. K., & Gumpert, D. E. (1980). Look to outsiders to strengthen small business boards. Harvard Business Review, 58, 162-170.

Jensen, M., & Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360. https://doi.org/10.1016/0304-405X(76)90026-X DOI: https://doi.org/10.1016/0304-405X(76)90026-X

Lima, A. C., & Filho-Joaquim, J. R. F. (2021). A ineficiência das renúncias fiscais sob a ótica da teoria da agência (Doctoral dissertation).

Lombardi, R., Tiscini, R., Trequattrini, R., & Martiniello, L. (2021). Strategic entrepreneurship: Personal values and characteristics influencing SMEs' decision-making and outcomes. The Gemar Balloons case. Management Decision, 59(5), 1069-1084. https://doi.org/10.1108/MD-10-2019-1416 DOI: https://doi.org/10.1108/MD-10-2019-1416

Lopes, A. (2012). Governança corporativa e a relação com desempenho e o valor das empresas brasileiras.

Machado, R. T., Grzybovski, D., Teixeira, E. B., & Silva, M. D. (2013). Governança de pequenas empresas familiares: Aspectos a considerar no modelo adotado. Revista de Ciências da Administração, 15(37), 198-210. https://doi.org/10.5007/2175-8077.2013v15n37p198 DOI: https://doi.org/10.5007/2175-8077.2013v15n37p198

Marion, J. C. (2015). Contabilidade empresarial (17ª ed.). São Paulo: Atlas.

Ministério do Empreendedorismo, da Microempresa e da Empresa de Pequeno Porte. (2024). Mapa de empresas - Boletim do 1º quadrimestre/2024. Recuperado em 20 out. 2024, de: https://www.gov.br/empresas-e-negocios/pt-br/mapa-de-empresas/boletins/mapa-de-empresas-boletim-1o-quadrimestre-2024.pdf.

Montemerlo, D., Gnan, L., Schulze, W., & Corbetta, G. (2004). Governance structures in Italian family SMEs. In S. Tomaselli & L. Melin (Eds.), 15th FBN World Conference Research Forum Proceedings (pp. 1-XX). FBN – IFERA Publications.

Nguyen, B., & Canh, N. P. (2020). The effects of regional governance, education, and in‐migration on business performance. Kyklos, 73(2), 291-319. https://doi.org/10.1111/kykl.12223 DOI: https://doi.org/10.1111/kykl.12223

Obeng, V. A., Ahmed, K., & Cahan, S. F. (2021). Integrated reporting and agency costs: International evidence from voluntary adopters. European Accounting Review, 30(4), 645-674. https://doi.org/10.1080/09638180.2020.1805342 DOI: https://doi.org/10.1080/09638180.2020.1805342

Organização para a Cooperação e Desenvolvimento Econômico (OCDE). (2019). Launch of “Digital for SMEs” initiative. Recuperado em 10 set. 2021, de: https://www.oecd.org/fr/industrie/launch-of-digital-for-smes-initiative-paris-november-2019.htm.

Ortega-Rodríguez, C., Licerán-Gutiérrez, A., & Moreno-Albarracín, A. L. (2020). Transparency as a key element in accountability in non-profit organizations: A systematic literature review. Sustainability, 12(14), 5834. https://doi.org/10.3390/su12145834 DOI: https://doi.org/10.3390/su12145834

Pindyck, R. S., & Rubinfeld, D. L. (2013). Microeconomia (8ª ed.). Makron Books.

Ralio, V. R. Z., & Donadone, J. C. (2015). Estudo sobre o histórico de atuação do SEBRAE na consultoria para micro e pequenas empresas brasileiras. Gestão da Produção, Operações e Sistemas, 10(2), 33-47. https://doi.org/10.15675/gepros.v10i2.1223 DOI: https://doi.org/10.15675/gepros.v10i2.1223

Ramos, R. S. (2022). A influência da governança corporativa na estrutura de capital das pequenas e das médias empresas que compõem o arranjo produtivo local de confecções do agreste de Pernambuco (Dissertação de mestrado).

Ramos, R. S., Santos, J. F., & Vasconcelos, A. F. (2017). A gestão dinâmica do capital de giro na indústria de confecções de Pernambuco. Revista Universo Contábil, 13(4), 84-103. https://doi.org/10.4270/ruc.2017427 DOI: https://doi.org/10.4270/ruc.2017427

Rocca, M. L. (2007). The influence of corporate governance on the relation between capital structure and value. Emerald Group Publishing Limited, 7(3), 312-325. https://doi.org/10.1108/14720700710756580 DOI: https://doi.org/10.1108/14720700710756580

Santos, V., Dorow, D. R., & Beuren, I. M. (2016). Práticas gerenciais de micro e pequenas empresas. Revista Ambiente Contábil, 8(1), 153-186. https://doi.org/10.21680/2176-9036.2016v8n1ID7271 DOI: https://doi.org/10.21680/2176-9036.2016v8n1ID7271

Schuster, W. E., & Friedrich, M. P. A. (2017). A importância da consultoria empresarial na gestão financeira das micros e pequenas empresas. Revista de Administração IMED, 7(2), 183-205. https://doi.org/10.18256/2237-7956.2017.v7i2.1950 DOI: https://doi.org/10.18256/2237-7956.2017.v7i2.1950

SEBRAE. (2024). Mortalidade empresarial: o que fazer para prevenir. Recuperado em 06 nov. 2024, de: https://digital.sebraers.com.br/blog/mercado/mortalidade-empresarial-o-que-fazer-para-prevenir/#:~:text=No%20Brasil%2C%20cerca%20de%2040,contribuem%20significativamente%20para%20esse%20cen%C3%A1rio.

SEBRAE. (2023). A taxa de sobrevivência das empresas no Brasil. Recuperado em 28 out. 2024, de: https://sebrae.com.br/sites/PortalSebrae/artigos/a-taxa-de-sobrevivencia-das-empresas-no-brasil,d5147a3a415f5810VgnVCM1000001b00320aRCRD.

Slomski, V. G., de Britto, A. A., Slomski, V., de Souza Vasconcelos, A. L. F., Lugoboni, L. F., & Imoniana, J. O. (2022). Compliance of management practices instituted in the third sector based on governance guidelines established by Brazilian organizations. Sustainability, 14(9), 536. https://doi.org/10.3390/su14095366 DOI: https://doi.org/10.3390/su14095366

Tetteh, L. A., Kwarteng, A., Gyamera, E., Lamptey, L., Sunu, P., & Muda, P. (2023). The effect of small business financing decision on business performance in Ghana: The moderated mediation role of corporate governance system. International Journal of Ethics and Systems, 39(2), 264-285. https://doi.org/10.1108/IJOES-01-2022-0014 DOI: https://doi.org/10.1108/IJOES-01-2022-0014

Tjahjadi, B., Soewarno, N., & Mustikaningtiyas, F. (2021). Good corporate governance and corporate sustainability performance in Indonesia: A triple bottom line approach. Heliyon, 7(3). https://doi.org/10.1016/j.heliyon.2021.e06359. DOI: https://doi.org/10.1016/j.heliyon.2021.e06453

Umrani, A. I., Johl, S. K., & Ibrahim, M. Y. (2015). Corporate governance practices and problems faced by SMEs in Malaysia. Global Business and Management Research: An International Journal, 7(2), 71-77.

Wendry, B., Nimran, U., Utami, H. N., Afrianty, T. W. (2023). The role of good corporate governance in mediating the effect of planning, coordination, supervision, and organizational culture on firm performance and firm sustainability. Environmental Development and Sustainability, 25, 2509-2521. https://doi.org/10.1007/s10668-022-02125-9. https://doi.org/10.1007/s10668-022-02125-9 DOI: https://doi.org/10.1007/s10668-022-02125-9

Westman, L., Moores, E., & Burch, S. L. (2021). Bridging the governance divide: The role of SMEs in urban sustainability interventions. Cities, 108, 102944. https://doi.org/10.1016/j.cities.2020.102944 DOI: https://doi.org/10.1016/j.cities.2020.102944

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Journal of Sustainable Competitive Intelligence

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish with this journal agree to the following terms:

1. Authors who publish in this journal agree to the following terms: the author(s) authorize(s) the publication of the text in the journal;

2. The author(s) ensure(s) that the contribution is original and unpublished and that it is not in the process of evaluation by another journal;

3. The journal is not responsible for the views, ideas and concepts presented in articles, and these are the sole responsibility of the author(s);

4. The publishers reserve the right to make textual adjustments and adapt texts to meet with publication standards.

5. Authors retain copyright and grant the journal the right to first publication, with the work simultaneously licensed under the Creative Commons Atribuição NãoComercial 4.0 internacional, which allows the work to be shared with recognized authorship and initial publication in this journal.

6. Authors are allowed to assume additional contracts separately, for non-exclusive distribution of the version of the work published in this journal (e.g. publish in institutional repository or as a book chapter), with recognition of authorship and initial publication in this journal.

7. Authors are allowed and are encouraged to publish and distribute their work online (e.g. in institutional repositories or on a personal web page) at any point before or during the editorial process, as this can generate positive effects, as well as increase the impact and citations of the published work (see the effect of Free Access) at http://opcit.eprints.org/oacitation-biblio.html

• 8. Authors are able to use ORCID is a system of identification for authors. An ORCID identifier is unique to an individual and acts as a persistent digital identifier to ensure that authors (particularly those with relatively common names) can be distinguished and their work properly attributed.